Products

A comprehensive suite of SaaS products tailored to simplify your business operations with cost-effective ROI

Cygnet Tax

Transform tax processes to ensure compliance

Cygnet Vendor Post Box

Automate end-to-end vendor management

Cygnet IRP

Approved Invoice Registration Portal by GSTN

Cygnet Bills

Cloud based billing solution to generate bills, e-Invoices and e-Way bills

Cygnature

Cloud-based digital & electronic signing solution

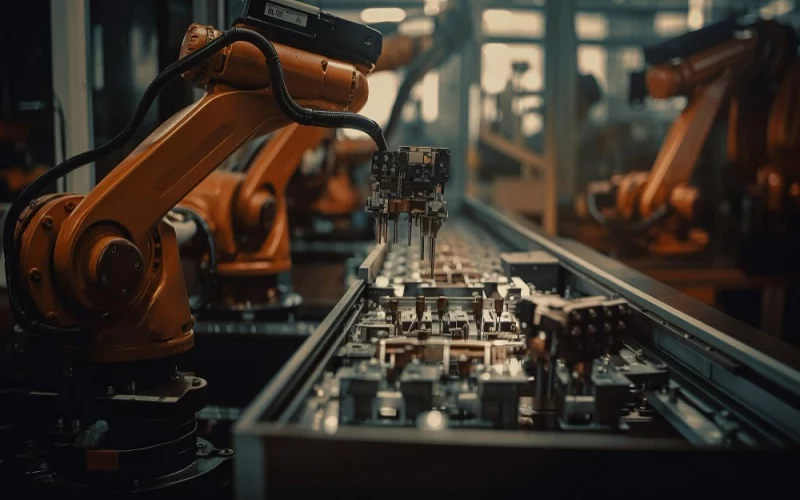

Automationwhiz

Automate business processes with RPA bots

TestingWhiz

Low code no code test automation tool

Cygnet Finalyze

Data-driven platform enabling real-time assessment for BFSI

Cygnet Origin

Onboarding journey for seamless experience

Services

Lead the digital transformation spectrum with Cygnet technology services

Digital Engineering

Revolutionizing enterprises with technology excellence

Quality Engineering

Elevate your standards with our precision-driven quality engineering

Enterprise Applications & SAP

Revolutionize your enterprise with our SAP and application solutions

Data, Analytics, AI/ML

Unleash the power of data with our analytics and AI/ML expertise

Security as a Service

Secure your operations with our robust Security as a Service

Solutions

Explore a diverse portfolio of comprehensive solutions crafted to enhance your business process transformation.

Accounts Payable

Enhance vendor relations by streamlining AP

GL Reconciliation

Streamline day-to-day GL reconciliation processes

Litigation Management

Introducing AI-Powered Notice Response Solutions

Source to Pay

Bring unparalleled efficiency to your S2P journey

Intelligent Document Processing

Template agnostic data extraction and processing with AI-OCR

One Stop Destination for

Indirect tax compliance

Transforming architectures with AI capabilities

Coalition of domain, integration and technical expertise

Client's complex legacy solutions modernization

Scalable infrastructure with 99% uptime

Client Satisfaction Rate

Scalable infrastructure with 99% uptime

Referral Based Business

Client's complex legacy solutions modernization

Over half a Billion e-invoices generated through Cygnet’s Platform

Clients Speak

Dive into the tapestry of experiences shared by those who walked the journey with us

Cygnet COSMOS

Digital Transformation Framework for Immersive Experience

Co-Ideate

Co-Ideate for new product development & new market GTM

1 Industry-First Approach

Co-Create

Co-Create technology enabled connected business solutions

2 Speed to Value

Co-Innovate

Co-Innovate intelligent solutions with Cygnet Launchpad

3 Value Based Method

Co-Evolve

Co-Evolve with a strong continuum of Cygnetians, Clients & Partners

4 Evolve Together

At Cygnet, we are driven by our commitment to Living the Trust, embodying our strong heritage and core values.

Resources

The more you engage, the better you will realize our role in the digital

transformation journey of your business